Retail Diary - Deep Dive - Week of March 11th 2024 - Retailer Check in and Luxury News

A round-up that helps show us the state of Retail, lots of Luxury news to dig into, launches & stories I love - let's have some fun with fashion & retail.

This Week's Topics:

Retailer Check-In

Luxury Fashion News

New Launches, Investments, Corporate Moves, Stores & News

What else I ❤️️

🛍️ Quick note: I write a lot (too much good stuff to share!) so if you’re reading via email only, you may need to click through to the web version or read on the Substack app. I promise it will be worth it. 🛍️

Retailer Check-In

It’s no surprise that retailers have been on a major roller coaster. The Retail Apocalypse, according to Wikipedia, “refers to the closing of numerous brick-and-mortar retail stores, especially those of large chains, beginning around 2010 and accelerating due to the mandatory closures during the COVID-19 pandemic.” to pull this out a bit more, here is the data I dug into:

From 2017, The Atlantic article “What in the world is causing the Retail Meltdown of 2017” by Derek Thompson is about the Retail Apocalypse from a time that when we had no idea what was coming (aka COVID’s long impact.) This article leaned into the rise of mobile shopping (driving traffic away from stores), too many malls and spending on experiences vs material items.

Fortune calculated that 12,200 stores closed in the US in 2020.

Coresight shared that in 2023 4,600 stores closed in the US. I was curious about openings to off-set this and the article ends with “But it's not all doom and gloom in the retail sector, given that retailers actually opened almost 5,500 stores in 2023, more than offsetting the number of closures this year, Coresight's data shows. In some cases, retailers moved into locations vacated by other businesses.”

In 2024, retailers are still finding their way. Some were growing rapidly and attracting acquisitions, but now they face pressure to generate profits and deliver returns to investors amidst intense competition for consumer attention and spending.

I was thinking of all of this as I dug into stories about retailers & brands now.

Matches Fashion - which I wrote about on Sunday. The latest (from both the SRD chat and The Line Sheet) is that returns have ceased for the retailer and brands are hoping to either get inventory back or be paid for the merchandise that hasn’t been paid for yet.

Outdoor Voices is closing all of its stores this week and offering 50% off retail in the brick and mortar locations. Stores were apparently given no notification that this was coming. OV was valued at $110 million in 2018 and by 2020 it had dropped to a $40 million valuation. (Time to stock up on an exercise dress.) More via The Cut.

Allbirds CEO and Co-Founder Joey Zwillinger is stepping down as CEO (will remain on the Board and serve as a special advisor) and effective March 15, COO Joe Vernachio will be the new CEO. According to Retail Dive, the brand plans to close 10-15 stores. Revenue was down 15% for 2023 to $254 million and projections for 2024 have it down another 25%.

Amid all this, I also found this article interesting, stating how Private Label Brands (PLBs) are gaining share over name brands last year. Last year PLBs hit 25.5% of total unit sales vs 24.7% the year before. Owned brands in food, shelf-stable beverages, refrigerated food, beauty and home all grew unit share, per the report. In the Retail Dive article Macy’s PLBs are noted, so perhaps that is a growth opportunity for Macy’s new chapter or for a retailer to pop in and acquire Raey from Matches/Fraser Group.

There has also been a shift in investing from PE (Private Equity) Firms investing in retail and consumer companies to large CPG (Consumer Packaged Goods) companies like Unilever and L’Oreal winning deals. A few reasons that PE Firms are not as interested in consumer brands include market challenges making it a riskier investment, the increased importance on e-commerce and the higher acquisition costs (which established CPG companies can potentially handle better at scale based on brands they currently manage.)

Believe it or not, Skims could change the IPO landscape for fashion brands. (Not sure if I finish that sentence with a “.” a “?” or a “!”) According to this article, Skims is redefining beauty with its inclusive vision, celebrating diversity from body shapes to skin tones. Emma and Jens Grede I believe to be the insights and retail powerhouses behind Skims, and Kim Kardashian as the “model”, aspirational influencer and have insights into the customer along with the Gredes knowledge. With sales growing from $500 million to $750 million in 2022, and a promising future ahead, it's a brand Wall Street is eager to support, thanks to its big digital presence, profitable growth, and commitment to inclusivity. (As for sustainability claims, check this out from

)

Ssense - A Bright Spot

The latest piece from journalist Rachel Tashjian at the Washington Post highlights the coolest and best on inspiring retailers and creatives with a strong POV - in this case, at retailer Ssense. “How Designer Clothes Make it to Your Wardrobe” (gift link to read behind paywall - enjoy!) shares more insights and behind the scene details with Brigitte Chartrand, Vice President of Womenswear (and the site’s “Everything Else”) Buyer partners with design houses, selects items and puts together the merchandising assortment. The Ssense website shopping experience and UX (User Experience) is unlike other sites and Chartrand’s goal is to make a shopper think of something they never thought of.

Luxury Fashion

A bunch of luxe fashion news spotted so I rounded up for us to discuss here. Any thoughts add to the comments and I’ll start a thread too in the chat.

Prada & Miu Miu - we love the fashion, and it is showing up on the bottom line for the company. “The Prada Group reported a stellar performance in 2023 and chairman Patrizio Bertelli on Thursday expressed his confidence in “further growth and evolution.””

Marisa Meltzer (who wrote the Glossy book - you can read my Book Club post on the book here) wrote this piece for the NY Times on Hermés Handbag designer Priscila Alexandre Spring “Will She Make the Next Birkin Bag?” After listening to the Acquired Podcast on Hermés recently (which I highly recommend) it was interesting to dive into the design and inspiration behind new handbags from the line and learn more about the Creative Director.

Celine News:

Celine released a video of the new looks one week after PFW ended. The looks are very 1960’s inspired, midcentury, and total looks. Put together pieces and styled perfectly but not overdone. Harper’s Bazaar wrote a great recap of the show - the show was dedicated to Richard Avedon and while there were no pants, there were plenty of tasteful mini skirts and shorts sets. The venues of the video were all Art Deco locations. Read Vanessa Friedman’s review from the NYTimes here.

Hedi Slimane is creating a beauty line for LVMH owned Celine. The house launched fragrance in 2019 and later this year will launch Rouge Triomphe, a lipstick available this Fall. A full line of 15 satin-finished colors will debut January 2025. Fashionista has more details including images and this quote “A satin "Rouge Triomphe" lipstick, described as "very classic and essential satin-finish Parisian... dressed in a faceted gold sheath and embossed with the maison's couture monogram," will launch this fall.” (Note: this also aligns strongly to the story below “Why Prices of the World’s Most Expensive Handbags Keep Rising” on luxury brands expanding into beauty to take advantage of a more accessible and entry price point for shoppers that are not purchasing multiple high-end items in a season.)

Chanel - don’t be surprised, prices are increasing for the handbags again via WWD. Data:

“The company has since grown into a megabrand, with revenues of $17 billion in 2022, up 17 percent year-on-year. Roughly half of those gains were due to price increases, and the rest volume, according to chief financial officer Philippe Blondiaux.”

“For the past few years, Chanel has increased its prices in March and September, and Pavlovsky confirmed another round of hikes was imminent, despite the slowdown in luxury spending that is causing many brands to ease up on price increases.”

“The price of a Chanel Medium Classic bag has gone from $5,800 in 2019 to $10,200 in 2024, an increase of 75 percent, according to New York-based reseller Madison Avenue Couture.”

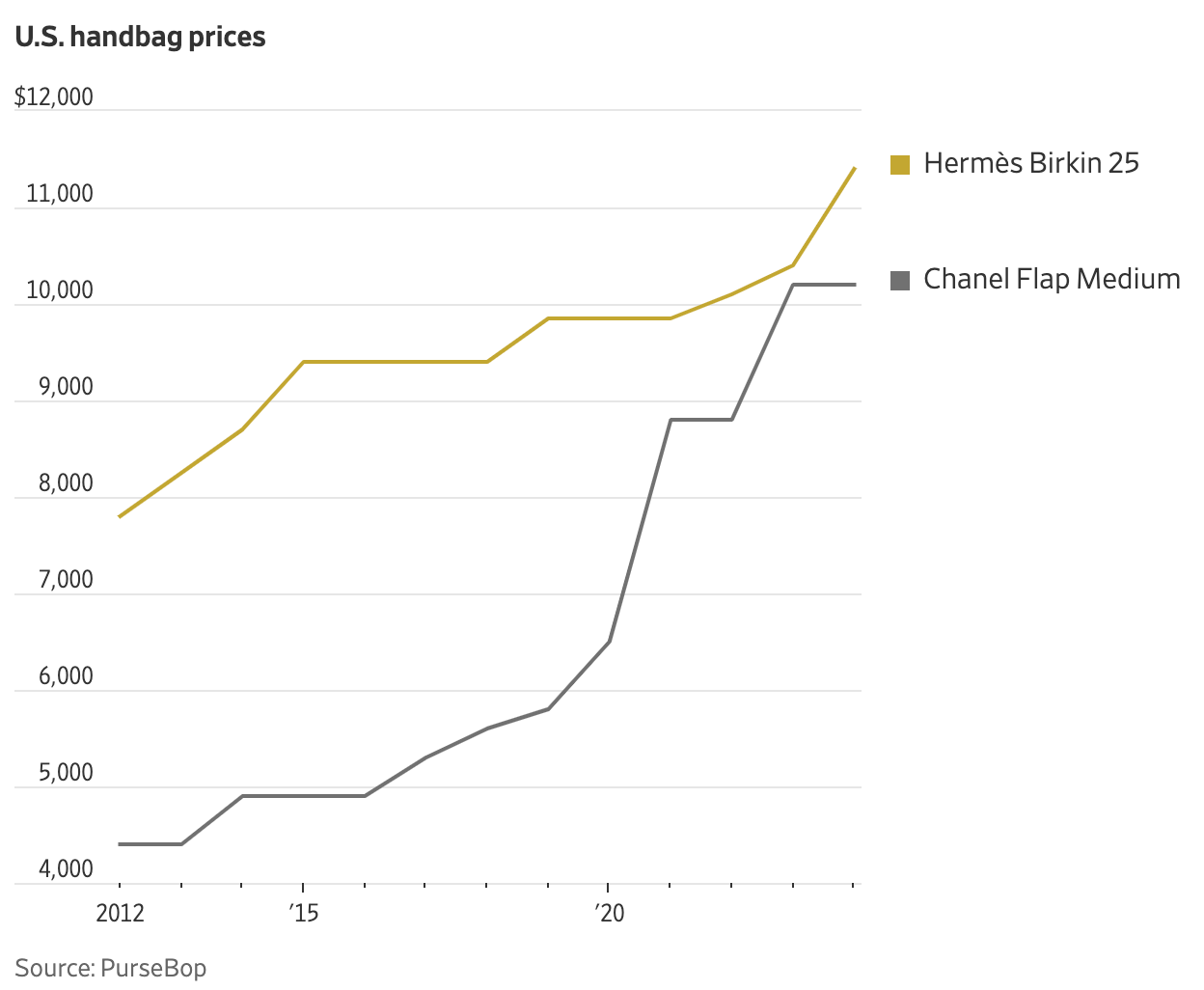

Carol Ryan wrote for the WSJ about the increasing prices of luxury handbags. “Why Prices of the World’s Most Expensive Handbags Keep Rising” (gift link to read behind paywall) shares data and a theory that the price increases are what is driving luxury fashion brands to launch beauty/cosmetic lines.

“The “Birkin premium”—the price difference between the Hermès bag and its closest competitor, the Chanel Classic Flap in medium—shrank from 70% in 2019 to 2% last year, according to PurseBop founder Monika Arora. Privately owned Chanel has jacked up the price of its most popular handbag by 75% since before the pandemic.” (see graph below from WSJ/PurseBop)

Since aspirational shoppers can no longer stretch in the same way to buy high-end bags (or at least multiple high-end bags a season) designer brands can over-populate the market with beauty without diluting the brand the same way a lower priced handbag or accessory would. (Although, Celine has done well with their baseball hat at a still luxury price that is less than a handbag and still visibly logo driven. Prada hats too.)

Cuyana’s Expansion into Luxury

I found this article from Business of Fashion by Marlique Morris really interesting. We often hear of brands launching diffusion brands at a lower price point. But Cuyana sees recent activity and interest in the brand as proof of an opportunity to go more upscale. I’m aligned and in agreement with what I’ve read from the article. Here is why:

As noted above, brands are increasing their price points at the high-end. As Chanel, Hermés, Bottega Venetta etc keep raising prices, that creates more space in the middle between opening price point brands, contemporary brands and then the high-end designers.

Additionally, validation from celebrities like Meghan Markle (is celebrity the right term for Markle??) and the ability to sell-out items after they are seen wearing shows that there is demand. (Two other great bags here and here - this functional tote is an incredibly popular work tote for the variety of ways to customize and use.)

Cuyana has always been positioned as a sustainable option - fewer, better has been a tagline that resonates with their shopper. Slower fashion and more thoughtful. The consumer who is concerned about this certainly wants to know the quality is there and is willing to spend more for it.

Cuyana is being customer centric here - they are not going after new consumers, but doubling down on the ones they already have and offering them functional and beautiful products.

From the article it also sounds like they will remain very focused on DTC but also expanding to retail partners, including speciality multi-brand retailers. This will help them with marketing and discovery - more traffic and visibility to their brand.

And of course, I love that they are already partnering with incredible influencers that have Substacks that are highly influential, for good reason, in the fashion space -

and to create content and host events.

All images via links in post.

New Launches, Investments, Corporate Moves, Stores & News

Launched

American Riviera Orchard launched today - Meghan Markle’s return to lifestyle instagram and a new brand. American Riviera Orchard could possibly sell home goods, cookbooks, tableware, and edible treats—like jams and fruit preserves.

Abercrombie & Fitch launched a bridal collection. The shop has everything for the bride, bachelorette, bridal party and wedding guests. Very smart for them to expand into this category and highlight as a collection - makes it easy for the consumer to shop and a category where a lot of money is spent.

Donni’s new summer collection launched (my favorite pair of pants here) and I’ve been hearing rumblings of capris coming back and we have further proof here of pedal pushers. (Honestly post bike shorts this doesn’t feel so far off.) (P.S. Need more proof, Retrofete has these.)

Pamela Anderson covers a Re/Done campaign and continues her gorgeous no-makeup look.

Knite Studio launched a line of ties - congrats to my friend and former coworker on her line. Perfect tie-ming based on recent trends (see Ayo Edebiri.)

Invested

Style Capital, a Milan-based Private Equity firm, has purchased a majority stake in sneaker brand Autry (or low-tops here or here). The brand is valued around 300 million Euros.

ShopMy just announced a $18.5 million investment led by Inspired Capital. This investment will be used to expand its network, product development and hiring. While ShopMy has been focused solely on fashion, beauty and lifestyle, the goal is to expand to other niches including maternity, fitness, wellness, and travel.

Corporate Moves

Curious what is going on at Under Armour. After just over 1 year in the CEO role, Stephanie Linnartz is stepping down on April 1st and Founder Kevin Plank will return as CEO.

Stores & News

Vestiaire Collective is looking to expands its US business. (If you are looking, here are a few fun finds: Gucci shearling horsebit handbag, a Toteme Scoat, a Loewe puzzle bag I’d pair with denim, while you save up for an Hermés bag - try a bag charm, combine two trends Schiaparelli + Brooch, Ladybug Dior or an art deco Dior Brooch.)

Gap showed positive growth on both the top and bottom lines. Moving in the right direction and exceed expectations. More from Retail Dive here.

The RealReal announced another strategic shift back into stores, looking to open up to 30 locations based in wealthy neighborhoods with a smaller footprint. The focus would be more on acquiring luxury items to resale vs to sell to consumers.

Moda Operandi is looking for investment from Private Equity for capital.

Revo opened its first US Store location in Soho and is looking to grow another 5-10 stores in the next 24-26 months.

What else I ❤️️

Diana Pearl wrote for the Business of Fashion “What’s Driving the Influencer Subscription Boom” about platforms, like Substack, offering opportunities for content creators and influencers to create their own subscription offering.

from Substack also offered tips for how to manage access when going paid. (I spy and in the lead image)If you appreciated the Ezra Klein podcast with

speaking about his book Filterworld and taste (many of us did) Chayka will be speaking at Business of Fashion’s upcoming BoF Professional Summit: New Frontiers: AI, Digital Culture and Virtual Worlds. BoF wrote about algorithms and fashion in the article “How Algorithms are Rewiring Fashion.”I really enjoyed listening to the Glossy Podcast interview with Sara Foster from Favorite Daughter. It was so interesting to hear how the brand came to be (the famous Favorite Daughter sweatshirt and I love this Go Sports sweatshirt to wear to kids games on the weekends - it works for every season.) They are looking to expand the brand into more lifestyle and accessory categories (beauty too) and it is so important how they are focused on exciting and engaging their top customers.

Loved this piece from

“Fashion Shows in a World of Angst” because I feel how tough, scary and anxiety filled the world is but the fashion of it all can be comforting and calming. I loved this line from the piece about favorite from the Paris Shows, Chemena Kamali for Chloé “No anxiety on display here even if there weren’t really any new ideas. It was an extremely nostalgic collection, which might be why we all loved it so much? Nothing like a little familiarity when you’re stressed out, no?”Rory Satran from the WSJ recaps all the pieces that she thinks will be the ones to watch from the recent shows.

Fara Homidi, which has the high-end and too hot to get a hold of lip compact, has launched an Essential Face Compact in a similar beautiful (and reusable) case (also find it here.)

Anyone else want to sign up for a landline after seeing this?

Data but make it Fashion calculates that button-down shirts are +3.7% up in popularity this month and I can’t help but think it is because of this Soldout shirt and the Chava new collection.

I saw this silver Dries Van Noten sneaker and I loved it. Feels like a flashier, fancier version of the Onitsuka Tigers or Wales Bonner Silver Sambas.

What's Next?

A fun Sunday Scoop this weekend (lots of trends and some styling Substacks I can’t wait to share!) and Retail 101 Part Deux: Accounting & Markdowns - out tomorrow (Friday March 15!) Spring Stripe Re-Fresh next week for a Fashion 🌀 Spiral.

Thanks for reading Deep Dive Edition 156

Sarah Shapiro

Recent Posts:

Tuesday’s Retail Diary: This Will Be Quick 3.12.24 - Oscars Fashion Recap

Sunday’s Retail Diary: Sunday Scoop - Philo Files, Matches Fashion, Airport Style & more

Last Week’s Week of March 4th 2024 - PFW & Resale News etc.

Retail 101: Math & Financials to prepare for Part Deux on Markdowns available Friday March 15th.

❤️ If you enjoyed this deep dive into all the latest retail news please click the like button at the bottom of this post so others can discover it.

📧 Maybe even share with someone else who would enjoy.

💬 If you are on the Substack app or platform join the chat and I’m happy to respond to any questions in the chat or comments.

You can email me at sarahshapiro@substack.com with any requests or thoughts.

Thanks for reading Sarah’s Retail Diary! Subscribe to receive new posts and support my work.

FYI: I use affiliate links where applicable which means I may get a small commission from things you buy (at no cost to you.) Thank you for supporting my work and trusting me. Love that we can enjoy Fashion & Retail together in this space. (Find all related pieces from this newsletter here)

You said a lot of interesting stuff here but the most striking thing was pedal pushers - my calves aren’t ready.

Chanel price hikes...oh boy. Love the notes about Skims and Cuyana - curious to see how these brands grow this year!