Retail Diary - Deep Dive - Week of April 22nd 2024 - Luxury sales, trend insights & more

Miu Miu & Prada hang on to the top spots, Kering is struggling, the latest on the Tapestry & Capri deal, Jewelry trends, Collabs & more.

This Week's Topics:

Miu Miu & Prada for the Win 🏆

Lyst Data Deep Dive 🤿

Luxury Brands - Financial Updates

Millennial & Gen Z Jewelry Trends

New Collabs, Launches, Investments, & Corporate Moves

What else I ❤️️

🛍️ Quick note: I write a lot (too much good stuff to share!) so if you’re reading via email only, you may need to click through to the web version or read on the Substack app. I promise it will be worth it. 🛍️

Miu Miu & Prada for the Win 🏆

Big news for Miu Miu, the Prada Group announced that the brand’s retail sales is up 89%. Prada, not as strong, but still showing growth up 7%.

The strength from past collections, like the short pleated mini skirt that was on the cover of multiple magazines, put Miu Miu and Prada to the top and it has been able to hang on to that spot. What is also exciting is that the brands/styles with a ton of momentum going forward are still Miu Miu and Prada.

I’m loving the overstuffed bags (I feel like I was the inspiration to this style! anyone else keep their life in their handbag?), pajamas and pearls, and did you see

style the bathing suit trunks - check out “Wear Test: Can You Style a Speedo Miu Miu Style?”Want to learn more? Check out a previous Fashion Spiral on Miuccia Prada here.

Now let’s dive into the Lyst data!

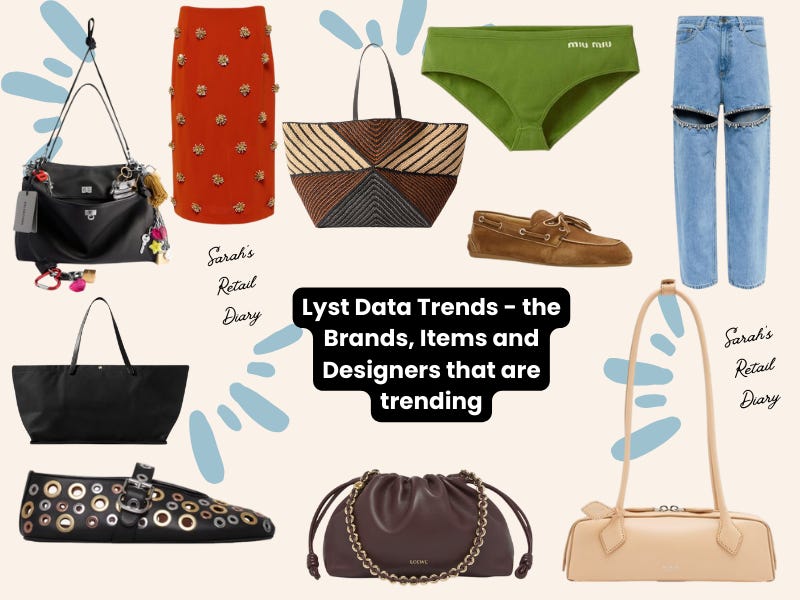

Lyst Data Deep Dive 🤿

The Lyst Index is a quarterly ranking of fashion's hottest brands and products, curated by Lyst. Lyst is a fashion technology company with over 200 million users annually, utilizing a formula tracking shopper behavior and social media engagement globally over three months (Q1 was January - March) to determine brand and product heat. Ahhh! This is the insights I love digging into.

Miu Miu moving up one spot to #1 brand. Who did they replace? Prada! Which moved to spot #2. Miu Miu had collabs with New Balance (a brand coming in at #15) and Church’s. Miu Miu also increased 88% searches with the male consumer. Miu Miu has 3 products in the top 10 ranking - the New Balance collab shoes, the retro swim trunks and a polo shirt from Miu Miu. Are we surprised the boat shoes are not in the top 10? I am - although I’m wondering out loud (silently as I type) if that drove non-branded search for “boat shoes” vs “Miu Miu boat shoes.”

Movement on the list/lyst worth noting: Balenciaga +4 (possibly from bouncing back post Winter 2022 campaigns - IYKYK) Kim Kardashian & Paloma Elsesser closet campaigns and the Rodeo bag. Burberry -3 spots despite their partnership with Harrod’s 175th anniversary. Skims, Louis Vuitton and The Row (many products helping, but especially the Idaho) all moved up spots too.

While Loewe has spot #3, JW Anderson (Jonathan also designs Loewe) is in spot #20 dropping one spot. I’m more impressed here with Jonathan Anderson’s overall impact having two brands in the top 20 and there is also all the incredible fashion from the Challengers movie - which he was the Costume Designer for.

The Alaia crystal ballet flats were the 4th most searched product. (Read more about the trend here.) (To shop some Alaia flats, check out grommets, a couple pairs of mesh here, gold and I think the Le Teckel could be in the top 10 next quarter.)

In the top 10 searched items, Taylor Swift’s Area denim from the Super Bowl came in at #9.

Dries Van Noten is moving up in searches due to DVN announcement of retirement. I keep seeing this embellished skirt popping up in closets and people shopping for. I found 1 left and one here.

Luxury Brands - Financial Updates

A comprehensive overview of recent financial updates concerning some of the most talked about brands/companies in the fashion industry.

The FTC sues to block Tapestry’s $8.5 billion acquisition of Capri. At the center of this is the term “accessible luxury” and if creating this larger corporation provides less competition for price across the brands.

Kering, the parent company of luxury brands Gucci, Saint Laurent and more, anticipates 40 to 45% (!!) dip in profits. Gucci, the flagship brand, faces significant challenges in China and beyond, raising concerns about its future trajectory. While there are glimmers of hope at brands like Balenciaga and Bottega Veneta, all eyes remain on Gucci's struggle to regain its footing in an ever-evolving market.

Business of Fashion/Bloomberg wrote “Can Kering Turn Things Around?” A brief recap: Gucci's recent outlet sale paints a picture of turbulence within parent company Kering SA. While rivals like Louis Vuitton and Chanel maintain exclusivity, Gucci's discounted offerings highlight management challenges, sparking questions about the future under CEO François-Henri Pinault's leadership. As Kering navigates these rough waters, investors and industry experts wonder if a fresh approach is needed to steer the ship back on course.

Millennial & Gen Z Jewelry Trends

Millennials and Gen Z consumers are trending to classic styles like Signet rings, tennis necklaces and bracelets, simple studs and pearls.

This article in WWD talks about a couple of the key brands. I would have also added Dorsey when discussing lab grown diamonds as they are definitely driving trends in tennis bracelets and necklaces.

Pearls are also trending from “lady-like” looks and FX: Feud The Swans. We’ve seen from the recent Miu Miu show that “pajamas and pearls”, preppy looks are in again and this works for pearl and diamond studs. Also, if you are looking to build a jewelry collection, all of these styles are a great place to start.

If you are looking for Mother’s Day or Graduation Gift ideas:

Signet rings that look great: mini (great graduation gift) and for mother’s day I love the idea of personalizing the stones in this ring. This super slim band signet is classic and fresh at the same time. But this onyx might be my favorite. I have a super simple signet ring from when I was a teenager that I’ve been wearing, very similar to this with my initial on it. (The OG Preppy, not the kids new version of preppy, is likely responsible for bringing back signet rings.)

Tennis necklace favorites: in lab grown this is what I wear in 15 inches and I’m into the idea of layering on a second one in a different cut and length. In natural diamonds, here is a mini tennis necklace or dream big.

Tennis bracelet favorites: I love the trillion from Dorsey and this dainty natural diamond is simple and stackable or classic here in a variety of carat weights. And how cool is this edgy take on a tennis bracelet?

Pearls: nice weight and well priced glass pearls, a unique choice, a forever classic and a great layering piece.

Earrings let’s do in the Sunday Scoop. I personally LOVE earrings and wear 6 tiny studs and mini hoops. 3 in each ear. I’ll share what I rotate wearing and others that would be fun additions.

New Collabs, Launches, Investments & Corporate Moves

Collabed

L.L. Bean x Summersalt on a summer swimwear line. It’s a robust assortment and is available on both sites. See on the Summersalt site here and on L.L. Bean here. What is interesting here:

Same styles available as Summersalt previously sold - Summersalt has some silhouettes that are proven and appreciated by their consumer.

With L.L. Bean they have new colors and fabric designs. On Summersalt’s site they showcase on the PDP1 with all colors and patterns - so you can purchase the same silhouette in a non L.L. Bean colorway.

I think the PDP on Summersalt is more informative and a more engaging design - so my preference would be to shop there (plus you might find a different colorway you like) but worth noting that the free shipping threshold is significantly lower on L.L. Bean’s website. So if you are looking to purchase a kids swimsuit I would suggest doing it on L.L. Bean’s site, adding in a boat & tote and get your free shipping.

Tan Luxe collabed with Paris Hilton on a new airbrush mist and mitt bundle.

Larroudé collabed with Cuban Artist Gabriela Noelle for a fun, bold and colorful collection. This collab also included a Miami Gallery event and content on larroude.com

Kylie’s clothing brand Khy launched a denim brand in collaboration with designer Natasha Zinko.

Launched

Glossier launched Strawberry balm dot com. For more of my thoughts and how they used customer feedback and insights on this launch, you can view my reel here.

Jacquemus launched a Wedding Collection. It feels really special and true to the brand. (Also congratulations to the designer on the birth of twins.)

Universal Standard launched an exchange program, Fit Liberty. If a customer purchases a product and wants to exchange for another size they are able to do so in the next year. (Note: at the time of typing on Wednesday 4/24 they are offering 40% off these products, which my assumption is to drive engagement and purchases into the program, have a successful launch, and generate enough future inventory for swaps.)

Aimé Leon Doré is launching golf. Read more about it in Hypebeast.

Saw via

that Jamie Haller launched RTW. It looks perfect for pairing with a pair of loafers. I’m especially drawn to this perfect grey sweatshirt (and I’m clearly not the only person who sees how this is a desirable shape and item. Already out of stock in the grey.)Kylie Cosmetics launches a new blush stick. I haven’t heard much about Kylie Cosmetics after the strength of the lip kits at launch, and I don’t see this being as strong for the brand as the lip kits were (her “brand” at the time was all lips and I don’t think of Kylie and blush/cheeks in the same way. There is also a lot of exciting blush competition - this target customer is likely using this or this at the moment. Of those two I would suggest the former.)

We are seeing more and more marketplaces launch this (Macy’s, Ulta, Nordstrom etc) and Walmart and Amazon have the most robust and established programs.

Many brands already know how important this resource/channel is for growth, discovery and awareness.

Saks also had vendors directly asking for this as they likely saw the model working on other sites.

This is great for Saks (and other retailers that launch Media Networks) as it creates a new revenue channel for them when retail/department stores are struggling. We’ve also seen The RealReal launch advertising on their site, but it is not to advertise the brands on the site.

Finally, this helps drive brand revenue - the onsite advertising is a push to drive engagement and brands can increase visibility, drive traffic to their products, and ultimately boost sales through enhanced exposure to engaged shoppers. Both saks.com and individual brands benefit from this.

The New Balance loafer isn’t launching until August, but Jacob Gallagher wrote about it for the WSJ “It’s Not a Sneaker. It’s Not a Loafer. It’s a ‘Snoafer’.” Overall, I’m seeing mostly positive reviews on the NB 1906L and it actually looks like a wearable sneaker hybrid - especially when it is thoughtfully styled, but still casual. (Read more from Retail Diary’s Sunday Scoop on a full round-up of “disruptive” shoes.)

Invested & Acquired

Experiment has closed $3.3 million in a seed round. Greycroft, a seed-to-growth investment firm where Katherine Power (Co-Founder of Who What Wear, Founder of Versed & Merit) is a partner, led the round. Katherine Power has a knack for building and growing skincare brands so this is a solid pairing making the brand one to watch. The product I’ve seen the most from Experiment is Softwear lip balm and I really like that they have a reusable face mask.

Corporate Moves

New CEO at Ganni, Laura du Rusquec, is the former deputy CEO at Balenciaga.

More news on Gregg Renfrew’s return to Beautycounter (she is the Founder and former CEO) and the relaunch on May 1st here from The Line Sheet and Rachel Strugatz.

What else I ❤️️

- Culture Study podcast this week interviewed Sarah Chapelle from Taylor Swift Styled on all things TTPD and Swift’s aesthetic.

Puck and Lauren Sherman launched the first Fashion People podcast and I highly recommend you subscribe - I love! I already know this will be an immediate listen twice a week as it enters my feed. First guest host was Jacob Gallagher.

Glossy Editor in Chief Jill Manoff was featured on the

Podcast interviewed byThis Business of Fashion profile on the handbag line JW Pei is an interesting case study. JW Pei found it challenging to be priced in the middle (I agree, there is a lot of confusion here and it is easier to be priced either low or high-end.)

While many brands choose to increase prices (and quality of product hopefully) and sell less, but earn more revenue, JW Pei decided to decrease prices with the goal to sell significantly more units.

Some of their popular bags include the Gabbi (at under $90 and in a ton of colors) and the Elise, which is cute for summer and is designed in a very luxe silhouette 😉 The brand also sells shoes now. They have both wholesale and sell direct to consumer.

What's Next?

I’m finishing Retail 101: Negotiations Chapter 3 this week and will send that soon. We are hitting May next week so I see a lot of swimwear launches in our future. We’ve already seen the summer-y sports (tennis, pickleball, golf) making big swings. Bloomingdale’s launched a summer campaign all around the theme of Camp and Moda Operandi has their Club Surf.

Thanks for reading Deep Dive Edition 162

Sarah Shapiro

Recent Posts:

I was quoted in Madeline Schulz’s Vogue Business article: “Why brands should follow Prada’s WNBA play”

Tuesday’s This Will Be Quick 4.23.24 - WNBA Style, Belts, Spring Styling & Fast Fashion vs Resale

Sunday Scoop - Attersee, Marin Shopping, "Ugly" Shoes and more

Last Thursday’s Deep Dive - Week of April 15th 2024 - WNBA, Tick Tock (watch) & so much retail news

Fashion 🌀 Re-Spiral: Seeing Stripes and Fashion 🌀 Spiral Kick Flare Pant Trend and Fashion 🌀 Spiral: In The Trenches and American Sportswear is having a moment

Retail 101: Math & Financials & Retail 101: Math & Financials Part Deux on Markdowns

❤️ If you enjoyed this deep dive into all the latest retail news please click the like button at the bottom of this post so others can discover it.

📧 Maybe even share with someone else who would enjoy.

📱Find Sarah’s Retail Diary on Instagram

💬 If you are on the Substack app or platform join the chat and I’m happy to respond to any questions in the chat or comments.

You can email me at sarahshapiro@substack.com with any requests or thoughts.

Thanks for reading Sarah’s Retail Diary! Subscribe to receive new posts and support my work.

FYI: I use affiliate links where applicable which means I may get a small commission from things you buy (at no cost to you.) Thank you for supporting my work and trusting me. Love that we can enjoy Fashion & Retail together in this space.

PDP = Product Detail Page. A webpage providing comprehensive information about a specific product found on e-commerce websites. It includes details such as product description, price, images, and customer reviews, aiding shoppers in making informed purchasing decisions.

I LOVE those overstuffed bags. I’ve seen a few people talking about really using your designer bags/ not being afraid of a little wear, so this felt right on par with that in a good way. Beauty meets function!

I don't think Raf Simons is the right fit for Prada.

But I like that Miuccia has been able to focus and tap into her creative superpower at Miu Miu, which is blossoming.

If you go into the stores or site, everything is super covetable, commercial, and "cool". Almost EVERYTHING has the logo, but it's not TOO ostentatious.